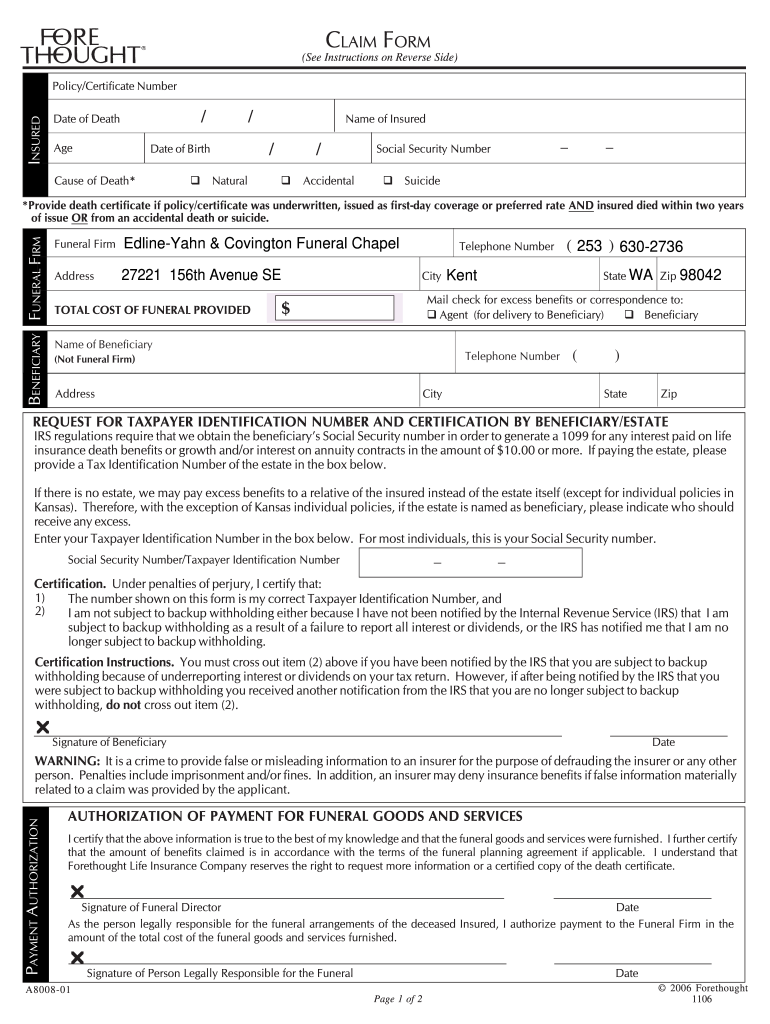

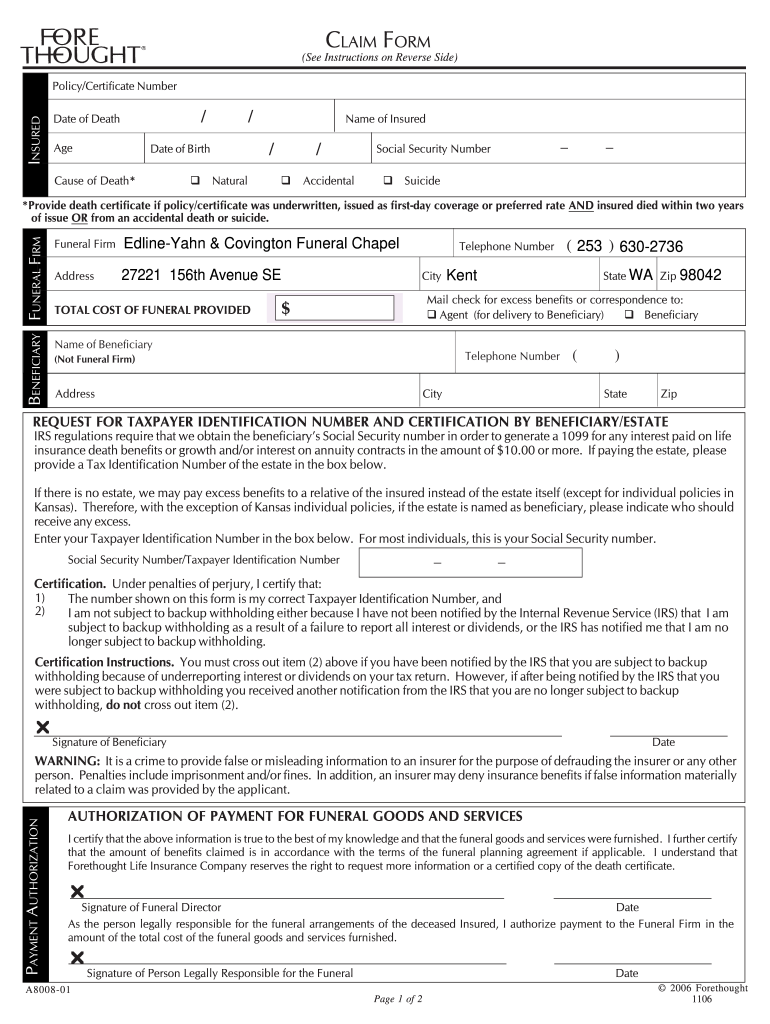

Get the free forethought life insurance claim form

Get, Create, Make and Sign

How to edit forethought life insurance claim form online

How to fill out forethought life insurance claim

How to fill out forethought life insurance claim:

Who needs forethought life insurance claim:

Video instructions and help with filling out and completing forethought life insurance claim form

Instructions and Help about global atlantic death claim form

Fixed index annuities are long-term insurance products for retirement some fixed index annuities have very competitive income paths and some have very competitive growth options available today but here is one fixed index annuity that has both introducing the forethought income 150-plus fixed index annuity a product built for lifetime income and account value growth consumers today are not interested in just one thing they want to know their money can grow and will guarantee a steady stream of lifetime income when they need it so how does it work with income 150-plus there are no tricky explanations for how contract value can grow instead there are four distinct boosts to the income base that make this annuity easier to understand at contract value and immediate twenty percent income boost is added to the income base which is a unique value within the contract that is separate from the account value and that is not available for withdrawal or a death benefit at the beginning of year three an additional 15 percent boost is added to the income base at the beginning of year five another 15 percent boost is added to the income base for a total income base equal to 150 of premium at the beginning of the fifth contract year in addition income 150-plus provides a guaranteed lifetime income benefit GI B which is an included rider for an annual charge of 095 of the income base also known as the income benefit factor with one of the most competitive payout factors in the country the income 150-plus product is issued by forethought life insurance company with an A — category rating from am best as of January 2014 ranked fourth highest of sixteen based on financial strength income 150-plus competes at the top of the charts when it comes to guaranteed income especially for those looking to take income in the first six years what about the plus in the beginning of contract year 10 the income base growth is calculated by multiplying the interest earned on the contract value over the first nine years adjusted forth draws by 150 and adding the result to the income base this Plus will give the final boost offering the potential for the income base to equal two hundred fifty percent of the premium paid adjusted for withdrawals so for those clients looking to defer guaranteed lifetime annual income for ten years or more the income 150-plus can be a great solution what about growth potential market volatility is one of the biggest challenges for retirement savings and income which is why we turn to fixed indexed annuities for greater predictability and growth potential however low annual growth caps can prevent contract values from experiencing higher growth potential income 150-plus provides a crediting method for an uncapped indexed interest strategy built around the volatility controlled index managed by one of our largest global asset management firms Barclays the Barclays armor tube gross USD 7 her index is a unique index that employs a multi asset allocation...

Fill forethought life insurance : Try Risk Free

People Also Ask about forethought life insurance claim form

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your forethought life insurance claim online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.